We help 25,000+ students each year become unstoppable

Looking to be the next stand out candidate in the numbers game? Well, here’s your opportunity. The Career Academy Diploma in Payroll will enable you to gain an intermediate level of knowledge and a strong understanding of payroll legislation and software, plus how to organise and analyse data in Excel. This practical course will set you up to be effective and efficient with some of Excel’s extended features, plus you’ll learn how to process payroll using payroll software.

10-Day Money Back Guarantee

12 Months Access | ~300 hours

100% online, study whenever suits you

Receive 24/7 support via email and phone

Industry-accredited Diploma

Pay in full for any course over $2,000 and receive a free 15.6-inch laptop. Call our Student Advisors 0800 342 829 to receive this offer!

Want to see more job outcomes and how your future could change?

This course gives you the practical skills, qualifications, and confidence to really stand out in the job market.

With courses accredited by leading organisations like the International Council for Online Education Standards (ICOES), CPD Standards Office, and IARC, you don’t just gain knowledge but also position yourself as an outstanding candidate with a qualification you can trust.

Stay connected with payroll professionals through exclusive networking events and industry forums. Keep updated with the latest in payroll legislation, regulations, and best practices in New Zealand.

This course provides a clear path to proficiency in payroll management, with options to achieve certifications in Xero Payroll and MYOB Payroll. These certifications bolster your qualifications and open doors to roles across multiple industries.

Our Payroll courses blend theoretical knowledge with practical application using industry-leading software like MYOB, Xero, and other payroll systems. This hands-on approach ensures you’re ready for real-world payroll management challenges.

Specialising in payroll can lead to lucrative career opportunities. In New Zealand, Payroll Officers earn between $60,000 and $80,000 per year, while experienced Payroll Managers may earn upwards of $90,000. By obtaining recognised certifications and mastering software like MYOB and Xero, you enhance your expertise and increase your earning potential.

Gain access to AAT’s Knowledge Hub and exclusive networking events, connecting you with professionals and staying updated on the latest trends in New Zealand’s accounting industry. This ensures you’re always in tune with new developments and opportunities.

Whether you prefer to pay upfront, weekly, fortnightly, or even monthly, we’ve got you covered. With our flexible payment options, you’ll have the freedom to choose the payment frequency that works best for you. No matter your budget or schedule, we’re here to make education affordable and accessible for you.

Pay Upfront

$2,499 + GST

One-off up-front payment

10-day money back guarantee

Normal Cost: $2,499.00 + GST

Pay in full for any course over $2,000 and receive a free 15.6-inch laptop. Call our Student Advisors 0800 342 829 to receive this offer!

MOST AFFORDABLE

Payment Plan

$49

PER WEEK

Budget friendly option with flexibility in payments

Pay weekly, fortnightly, or monthly

No deposit, no credit check

Total Cost: $2,499.00 + GST

Essential New Zealand Employment Legislation – 6th Edition

by CCH Editors

This valuable book brings together key employment legislation specifically selected for human resource practitioners, employment lawyers and advocates, union officials and students.

Consolidated to 11 April 2022, Essential New Zealand Employment Legislation includes the privacy statute, key secondary legislation affecting workplace responses to the COVID-19 pandemic, and the Matariki Day amendments. Other noteworthy changes since the last edition include amendments relating to pay equity, family violence leave, collective bargaining and triangular employment.

Foundations of New Zealand Taxation Law 2023

by S Barkoczy

Foundations of New Zealand Taxation Law provides a clear and concise introduction to the policy, principles and practice underpinning New Zealand’s tax laws. Written by a panel of tax academics and tax experts in practice, this 2023 edition has been revised and updated to take into account significant tax developments up to 1 September 2022. Ideal for students seeking a straightforward explanation of the fundamentals of taxation law within a framework that provides context and historical background, the text includes a series of study questions at the end of each chapter to aid with preparation for exams and assignments. Foundations of New Zealand Taxation Law is designed to be used in conjunction with New Zealand Tax Legislation for Students.

Fringe Benefits – A Practical Guide to Managing your Tax Costs

by Andrew Dickeson

Fringe benefit tax (FBT) is arguably one of the most controversial and costly taxes for any New Zealand business to administer. The fifth edition of this practical book uses worked examples, case studies and checklists to illustrate the meaning of the law and the context in which FBT might arise.

GST – A Practical Guide Edition 10

by Alastair McKenzie

Alastair McKenzie’s GST – A Practical Guide is widely considered to be the authoritative New Zealand text on goods and services tax. In addition to covering the broad framework and operation of GST in New Zealand, the book provides in-depth coverage of special problem areas and contentious issues regarding the application of the Goods and Services Tax Act 1985. The first part of the book sets out the broad framework and operation of GST in New Zealand. The second part provides in-depth coverage of difficult and contentious issues regarding the application of the Goods and Services Tax Act 1985. Topics tackled include: mortgagee sales, hire purchase, barter, nominations and assignments, s and refunds, rental properties, insurance, adjustments for mixed-use assets and periodic payments.

Labour and Employment Law Manual – 3rd Edition

by Joydeep Hor

An essential strategic resource for anyone working in employment law, including lawyers, industrial and employment relations practitioners, human resource (HR) specialists, people managers and in-house HR counsel. This Manual assists readers in grappling with a range of strategic solutions to numerous people-related legal issues. In addition to its comprehensive legal commentary, the Manual contains numerous case studies, flowcharts and checklists that enable decision-makers to be properly informed across this highly complex and evolving area of the law.

Managing Workplace Behaviour: A Best Practice Guide

by CCH Editors

This new title gives an insightful look into the issues relating to behaviour and culture in the workplace. This book also looks at how technological and social networking advances are impacting the workplace. By providing a legal insight into why these matters present challenges for organisations, this publication looks at how behavioural change results in cultural change.

Contents Includes:

-Introduction: The future of behaviour and culture in the workplace

-History and evolution: International obligations, State and Commonwealth laws, bodies and tribunals

-Discrimination: Behaviours and grounds

-Sexual harassment: types, areas, specifics

-Bullying

-Other offences

-Liability and damages

-Resources

New Zealand Master Tax Guide for Students 2023

by CCH Editors

Providing a straightforward approach to New Zealand tax law, this guide covers all legislative and case law developments up to 31 December 2022, including: ▪ significant reform of the interest deductibility rules for residential rental properties ▪ further changes to the bright-line test, including tweaks to the main home exemption and a 5-year bright-line test for new builds ▪ modernising the GST invoicing rules ▪ introducing a new option for calculating fringe benefit tax ▪ the business continuity test for carrying forward losses ▪ penalising the sale or possession of sales suppression software ▪ rules for the GST and income tax treatment of cryptoassets ▪ extension of COVID-19 relief measures.

New Zealand Practical Accounting Guide

by Marsden Stephen J.

This practical guide covers not only bookkeeping essentials but also a range of accounting and taxation issues that tax agents and bookkeepers need to be aware of when dealing with their clients. It has a very practical approach, with numerous worked examples, diagrams, checklists, tables and FAQs. Topics covered include: overview of basic bookkeeping and accounting principles how to prepare a set of financial statements for clients key taxation principles that bookkeepers need to be aware of, including income tax, GST, and FBT guidance on the practicalities of payroll and KiwiSaver comprehensive examples on how to prepare a GST return under both the invoice and payment basis a list of commonly asked questions at the end of each chapter.

New Zealand Tax Rates, Dates and Depreciation Rates 2024 Edition

by CCH Editors

New Zealand Tax Rates, Dates and Depreciation Rates is an easy-to-use volume comprising all New Zealand’s depreciation rates in table format, consolidated to 1 January 2024.

An essential reference tool for tax practitioners, students and anyone involved in business.

NZ Master Bookkeepers Guide- 3rd Edition

by Stepehn J. Marsden

This practical guide covers not only bookkeeping essentials but also a range of accounting and taxation issues that tax agents and bookkeepers need to be aware of when dealing with their clients. It has a very practical approach, with numerous worked examples, diagrams, checklists, tables and FAQs.

Payroll: A Practical Guide to New Zealand Payroll Administration 2018

by W Heads & R Saheed

Administering the payroll is one of the most critical and demanding functions of a business. This comprehensive, easy-to-use guide clearly explains the essential components of all pay office functions and procedures. The book provides a simple and up-to-date explanation of legal and tax implications relevant for payroll purposes and is an invaluable resource for payroll administrators, business owners and advisers.

Preventing Workplace Bullying and Harassment

by Hadyn Olsen

Managers and supervisors are key people in organisations when it comes to the prevention of bullying and harassment. This handbook has been written to give them practical guidance and to answer some of the most common questions they ask:

-How do I identify what is bullying/harassment and what isn’t? Where’s the line?

-How do I stop bullying/harassment if I know it’s happening?

-What is the difference between informal and formal interventions? What’s my part in this?

-What should I do when someone tells me they are being bullied or harassed?

-How should I respond if I am accused of bullying when I am trying to manage someone?

-How can I help create a work environment that prevents bullying and harassment from happening?

So Now You Want to Get Paid!

by Graham B Pomeroy

“Buy now, pay later” is increasingly a facet of New Zealand life, and there is pressure on businesses to grant more credit to get more sales. So Now You Want to Get Paid! clearly outlines the important aspects of credit management and debt recovery. This book will give you guidance and practical techniques, helping you save money and minimise risk while providing you with industry-recognised practices to recover what you are owed. Endorsed by the New Zealand Credit & Finance Institute, the second edition of this popular book is an indispensable guide for businesses, their financial and legal advisers, and anyone else involved with credit management.

Summit Leadership: Strategies for building high performing teams

by Nick Humphrey

The latest book from best-selling business author, Nick Humphrey, is a practical guide to leadership and is the result of extensive interviews with high-achieving leaders including insights from elite coaches and athletes, CEOs, psychologists, serial entrepreneurs and even some Royal Marines Commandos. It brings together strategies, habits and hacks of peak performers and the latest research from management theorists.

The book deconstructs the art and science of building high performing teams including value-based leadership, mindfulness, positive leadership techniques, attracting talent and also tips for enhancing your employees experience.

The Big Issues in Employment: HR Management and Employment Relations in Australasia – 2nd Edition

by Jane Parker and Marian Baird

Following the 2013 edition, which focused on New Zealand, this new volume examines the important issues within both human resources management (HRM) and employment relations (ER) in Australasia. The book actively seeks to raise academic, policy-maker and practitioner awareness of the key debates that need to be addressed to help New Zealand and Australian organisations to adopt more cutting-edge approaches to HRM and ER.

Upon successfully completing your course, you’ll be awarded a Certificate of Achievement from The Career Academy. This certificate not only recognises your hard work but also serves as an industry-accredited qualification that will help you stand out in the job market. Whether you’re aiming for a new job or looking to get promoted, this certificate will open doors to better career opportunities.

Our tutors are here to help you every step of the way. They’re not just knowledgeable, they’re passionate about your success. Whether it’s a quick question or detailed guidance, you’ll have unlimited access to tutor support via phone and email. We’re committed to ensuring you feel confident and supported throughout your learning journey.

Accounting & Bookkeeping Tutor

Saharah radiates positivity and charm with her naturally bubbly personality and effortlessly light-hearted approach. With a found appreciation for knowledge and education, viewing them as essential pillars of personal and professional development. Saharah’s dedication to staying informed and cultivating a well-rounded perspective not only enriches her own life but also positively influences those around them, fostering a culture of curiosity and intellectual exploration.

Accounting & Bookkeeping Tutor

With a Bachelor’s Degree in Accountancy, Gracezel has cultivated a diverse and dynamic career in the finance sector. From roles as a Finance Business Analyst and A/R Associate, she has gained extensive experience managing financial operations and optimizing business processes. During the pandemic, Gracezel pivoted to teaching, sharing her expertise in basic accounting with college students. This transition was driven by her deep passion for education and her commitment to making a positive impact on students’ futures, helping them achieve their career goals.

In addition to professional achievements, Gracezel is a dedicated first-time mom and an enthusiastic small business owner, balancing the demands of entrepreneurship with the joys of family life. Outside of work, she enjoys reading, unwinding with Netflix, and exploring new destinations through travel, finding inspiration and relaxation in these diverse interests.

Fuelled by a love for teaching and a commitment to personal and professional growth, Gracezel continues to inspire and support those around them while embracing the rich tapestry of life’s experiences.

Administration, Psychology & Counselling Tutor

Dana graduated with a Master of Science in Psychology. Her research focuses on attention, cognitive control, and visual perspective-taking using methods such as VR, hand-tracking, and eye-tracking. Dana also worked as a graduate teaching assistant at a local University for several courses in psychology. With a deep passion for both teaching and psychology, Dana is dedicated to developing educational experiences that are both supportive and enriching. In her spare time, Dana enjoys watching movies with her beautiful cat and partner.

Psychology, Administration & Management Tutor

Rita is a Psychology, Administration & Management Tutor with a bachelor’s in psychology. She has worked in administrative roles and as a behavioural therapist, along with over 5 years of experience working as a tutor. These experiences enable Rita to support students’ learning and assist them to achieve their career goals and gain new opportunities. Outside of work, Rita enjoys spending time with her dogs, hiking, traveling, and watching films and shows.

Accounting & Bookkeeping Tutor

I obtained a Bachelor of Business Studies majoring in Accounting from Waikato Institute of Technology. During my time studying, I mentored several international students in a range of topics including commercial law, marketing, accounting & finance. Not only did this give me lots of energy watching my students grow, it also deepened my understanding of these topics as well as how to relate to people.

It is no surprise that I came to The Career Academy – with a teacher for a mother, it’s just in my blood.

Outside of work, I like to relax by playing football with my teenage sons, dance to Baila music, read, or cook delicious meals with my wife.

Administration, Management, Psychology & Counselling Tutor

Amoré is an Administration, Management & Microsoft Office tutor who works with The Career Academy to help students achieve their career goals. Amoré has a Bachelor of Arts Degree specialising in Psychology, English and a Certificate in Language Teaching (CELTA), along with many years of working within the administration and education field. These qualifications coupled with years of experience in various industries enables Amoré to provide the best education experience for her students.

When Amoré isn’t helping students to achieve the very best out of their studies, she enjoys travelling with friends , yoga, and creating artwork in her free time.

Accounting and Administration Tutor

Dessa is a seasoned accounting teacher with ten years of experience teaching at the university level and holds a master’s degree in business administration. She has worked as a Certified Public Accountant giving her a strong foundation in real-world financial operations and reporting. She is passionate about empowering students with the skills and confidence they need to thrive in their academic and professional careers. Away from work, Dessa enjoys staying active at the gym, attending Zumba classes, and spending quality time with her husband and daughter.

Accounting & Bookkeeping Tutor

M. E. is a dedicated tutor at TCA, bringing a wealth of knowledge and experience in both Financial and Managerial Accounting, supported by her CMA and CPA certifications. She is deeply committed to transforming accounting into an engaging and enjoyable subject, using her expertise to make complex concepts accessible and exciting for her students.

In addition to her accounting prowess, M. E. has a rich background in the real estate industry as an appraiser, further broadening her professional scope. Her passion for learning and discovery extends beyond the classroom; she loves traveling, meeting new people, and immersing herself in diverse experiences. Her dedication to student success transforms learning into a collaborative journey, guiding each student toward their highest achievements.

Accounting & Bookkeeping Tutor

As the Accounting & Bookkeeping Tutor at The Career Academy, Erika is responsible for supporting and assessing student’s education in gaining competency in the accounting and management field. The Career Academy’s vision is to deliver an exceptional online experience, and she contributes to this by offering student support while fostering positive, harmonious relationships.

She is driven by a passion for continuous learning and a desire to make a difference. She loves impactful work, especially when it involves sharing her knowledge and experience with others.

She earned a bachelor’s degree in accountancy in the Philippines and obtained my License as a Certified Public Accountant.

In my downtime, I immerse myself in the enchanting worlds of fantasy novels, losing myself in captivating tales and magical realms.

Accounting & Bookkeeping Tutor

Mariel is an Accounting and Bookkeeping Tutor at The Career Academy with over six years of experience teaching accounting, finance, and business subjects as a professor in the Philippines. She holds a Master’s in Business Administration and has worked in property management accounting, gaining hands-on experience in financial reporting and budgeting.

Outside of her role, Mariel provides private tutoring to students worldwide and has a strong interest in psychology, which she integrates into her teaching approach. In her free time, she enjoys hiking and writing blogs that reflect her love for learning and personal growth.

Accounting & Bookkeeping Tutor

A competent Certified Public Accountant (CPA) who is currently shaping minds as an Accounting and Bookkeeping Tutor at TCA. He is more than willing to help students in their studies as they go through a journey of acquiring new skills, exploring uncharted territories of knowledge, and building improved career pathways. His reliability is not just built on continuous professional development in the field of accounting and bookkeeping but also founded on values of empathy, patience, and genuine enthusiasm to help students.

Our Accounting courses prepare you for exciting roles in finance and business. Whether you want to work with a small business or a global corporation, we’ll equip you for roles such as:

The Career Academy is committed to helping you upskill so you can get a new job or gain a promotion. Upon enrolment, you’ll receive instant access to our Career Centre and benefit from:

We also offer extra job and career support for those that want to upgrade to the Career Success Bundle. When you upgrade to this, you’ll receive these fantastic benefits:

Read through our student’s incredible journies with us at The Career Academy.

Hiromi’s Journey into Bookkeeping

Hiromi found the perfect work-life balance after enrolling in The Career Academy’s Certificate in Bookkeeping. As a busy mum, the flexibility of online study allowed her to pursue her dream career while caring for her family. Upon completing her course, she secured a role with The Back Office Company and began her journey in a new profession.

George’s New Career in Accounting

After moving from Greece, George pivoted from dentistry to accounting with The Career Academy. His online learning journey, starting with the Certificate in Accounting, allowed him to balance study with work. Now, he’s well on his way to becoming an Accounting Technician, with professional qualifications recognized worldwide.

Nikki’s Drive for Success in Accounting

Nikki switched gears from rally co-driver to qualified Accounting Technician, thanks to her studies at The Career Academy. With industry-recognized qualifications under her belt, she landed a role at Robinson Interiors and even became a tutor at The Career Academy, helping others pursue their career dreams.

Christine’s Determination to Succeed

Despite facing health challenges, Christine pursued a career in medical reception through The Career Academy. The Certificate in Medical Reception provided her with the skills and confidence to work in a medical practice, allowing her to increase her workload and achieve her professional goals.

Samantha’s Leap into Bookkeeping

As a busy mum of two, Samantha needed flexible study options, which she found with The Career Academy. After completing the Certificate in Bookkeeping, she quickly transitioned into an Office Manager role and is now working towards opening her own business.

Carol’s Career in Bookkeeping

Carol balanced family life, a full-time job, and the management of her family’s restaurant while completing the Certificate in Bookkeeping with The Career Academy. Her newfound qualification has given her the confidence to support the business and further her accounting career.

Hannah Balances Work And Studies To Unlock Her Bright Future

Hannah wasn’t sure what career path to take, but after enrolling in the Certificate in Reception & Office Support at The Career Academy, she discovered her passion. Now working as a Sales Administrator, she’s continuing her educational journey with a Bachelor of Business.

Sabrina’s Shift to Accounting

After having a baby, Sabrina needed a flexible way to study, which she found with The Career Academy’s AAT Accounting Technician Pathway Program. Now, she’s using her accounting qualifications to help others, having transitioned from student to tutor at The Career Academy.

Leanne’s Accounting Transformation

Leanne had decades of experience in accounting but needed a formal qualification. After completing the Certificate in Bookkeeping at The Career Academy, she gained the confidence and recognition she needed to advance her career, and she’s now pursuing further study in accounting.

Jill’s Bookkeeping Career

Jill made the most of her time during the COVID lockdown by upskilling through The Career Academy’s Certificate in Bookkeeping. Now, with official qualifications, she’s well on her way to becoming a professional bookkeeper while continuing to enjoy life on the road.

Ashley’s Shift to the Medical Industry

Ashley transitioned from hospitality to the medical field after completing The Career Academy’s Medical Reception & Terminology course. Her newfound passion for the medical field is leading her to pursue further studies in midwifery, all thanks to the flexibility of online learning.

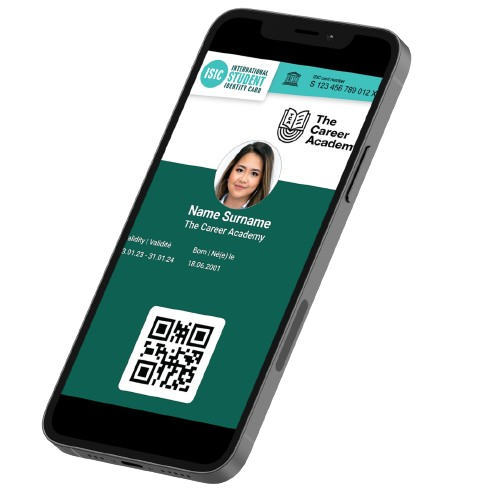

Once you enrol you will receive a Student ID card, allowing you to instantly prove your official status and access over 150,000 students s both in The Career Academy and around the world.

Key Benefits:

Summer Vanstan

Georgia

Madisin Mosen

Marija Bizjak

Cassandra

Santana Barnes

Demacs Constructions

gabokNZ

Jessica Rollinson

Ghan Shyam

Sonya Hazim

Risalyn Malijan

Deborah Peel

Komal Matela

T Wright

Kelcy Lewis

Claudia

Catherine Jorden

Request a free course guide to:

By submitting this form, you consent to a student advisor contacting you via phone, email and SMS to discuss course options that are suitable for you.

Your information is safe with us. By submitting this form, you agree to our Privacy Policy

There are no entry requirements or pre-requisites to enrol into this course. You can enrol online directly by selecting your course and clicking on “Enrol Now” and follow the prompts. Alternatively, you can enrol over the phone with our friendly student advisors. Give them a call on 0800 342 829 or email them at [email protected]

FOR